What is a liquidity provider?

What role does the staker play in the NFTX ecosystem, what is their incentive?

A staker is someone who adds liquidity to the NFTX vaults and stakes that liquidity on NFTX to earn a share in the vault fees.

There are two roles the staker can have within the NFTX ecosystem.

- Inventory provider, assists the vaults by adding more NFTs into the pool and providing shoppers with a broader choice of NFT.

- Liquidity provider, assists the vaults on the NFTX platform by creating a larger liquidity pool. With a larger liquidity pool, there is less price impact when someone buys or sells NFTs on the platform.

What are the types of staking available?

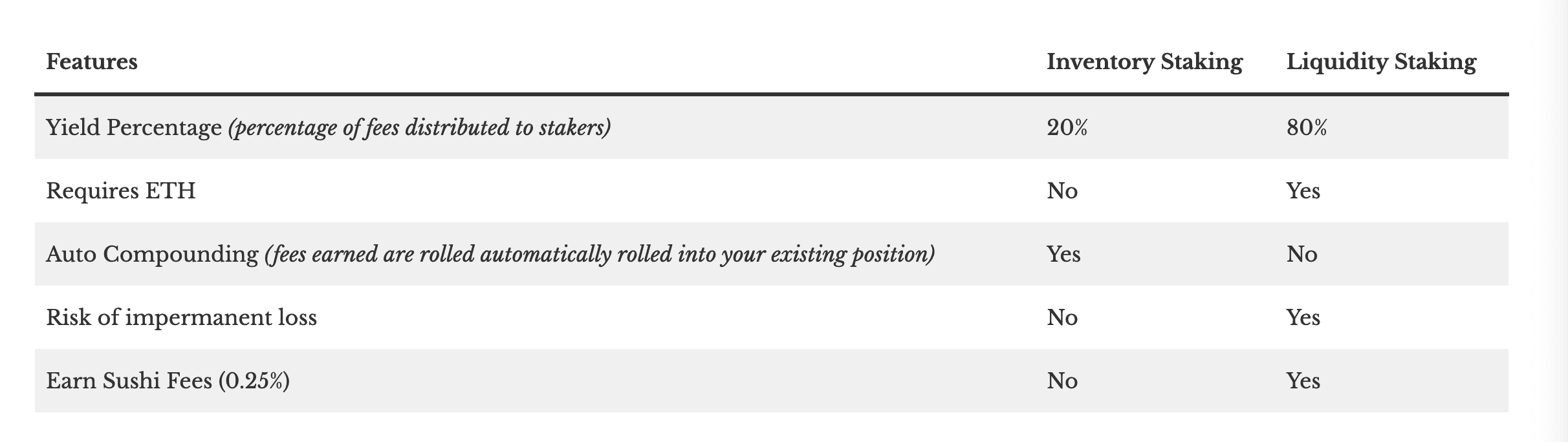

There are two types of staking on NFTX.

- Inventory Staking (NFT only)

- Liquidity Staking (NFT + ETH)

Liquidity Staking

Liquidity staking was how NFTX liquidity pools were originally setup, the only way you could stake your NFTs was to add equal parts NFT and ETH into the pool.

This allowed you to get a share of the pool that received 100% of the fees generated through buy/sells/swaps on the vault/pool you were staking in.

Since the inclusion of inventory staking, the liquidity staking will now get an 80% share of all the fees with the other 20% going to those that are inventory staking.

In the event where there are only liquidity staking, the 20% fees generated will go back to the NFTX DAO until there is at least one inventory staker.

Inventory Staking

Inventory staking allows users that have NFTs to stake without also needing to include ETH into the liquidity pool. This is primarily to increase inventory, which in turn will provide a wider variety of NFTs to buy/sell/swap, which in turn will create more fees, which in turn will encourage additional staking for both inventory and liquidity.

With the addition of inventory staking, the fee structure has been updated to provide 20% of the fees generated to inventory stakers and 80% of the fees go to liquidity staking (who are providing ETH as well and therefore have larger rewards).

In the event that there is only inventory staking, 100% fees generated will go back to the inventory stakers until there is at least one liquidity staker.

How do concentrated liquidity pools work?

To allow users to be able to buy NFTs from the vault they need access to Vault Tokens, and to allow users to sell NFTs into the vault they need access to ETH.

To ensure we have some of each, a Concentrated Liquidity Pool exists (this allows trades to happen without having another buyer for a seller, or a seller for a buyer).

When lots of people are buying the price goes up. When lots of people are selling the price goes down.

How does providing liquidity for a vault work (liquidity staking)?

Fortunately we’ve wrapped the entire process into a simple one click zap, however this is the process behind the scenes.

- NFT added — The NFT selected is added into the NFTX Vault.

- ERC20 Token Minted — An ERC20 token is minted as a 1:1 representation of the NFT added to the vault.

- ERC20 + ETH added to the pool — The ERC20 tokens plus the equivalent ETH is added to the vault liquidity pool on Sushi.

- SLP Generated — An SLP (Sushi Liquidity Pool) token is generated to represent your position in the liquidity pool

- SLP Staked — The SLP is then staked on NFTX which generates xTOKENWETH tokens which are in your wallet

- Earn Yield — You earn a share of all the vault fees that are generated on the vault.

Example with CryptoPunks

Step 1: Mint vault tokens.

To mint a vault token you must hand over an eligible NFT to the vault. For example, to mint a PUNK token you need to give a CryptoPunk NFT to the vault. The vault token you get in return represents ownership of one random NFT from the vault.

Normally it makes sense to buy the cheapest items from a collection and use those to mint tokens, since you receive a single token regardless of an item’s unique value.

Step 2: Pair tokens with ETH and deposit on Sushiswap.

Sushiswap is a DeFi app for trading tokens and it has two types of users: liquidity providers (LPs) and traders. LPs deposit two assets in equal valuations and then charge a fee to anyone who wants to trade those assets. For example, LPs can deposit PUNK & ETH and then traders can trade PUNK for ETH, or ETH for PUNK.

In return for depositing liquidity on Sushiswap, liquidity providers receive SLP tokens which represent their portion of a particular sushiswap liquidity pool.

Step 3: Stake SLP tokens on NFTX to earn yield.

After depositing on sushiswap, LPs can then stake their newly received SLP tokens on NFTX and earn fees from people beople buying and selling NFTs.

Using the PUNK vault as an example, everytime a specific cryptopunk is bought or sold, 0.05 PUNK tokens are earned and distributed to LPs who have staked their SLP tokens. The logic here is similar to sushiswap—essentially a fee is charged to users who want instant liquidity and rewarded to users who supply that liquidity.

Next, let’s take a look at how you might pick the right collection to stake.